Executive Overview: Q3 Insight Focus

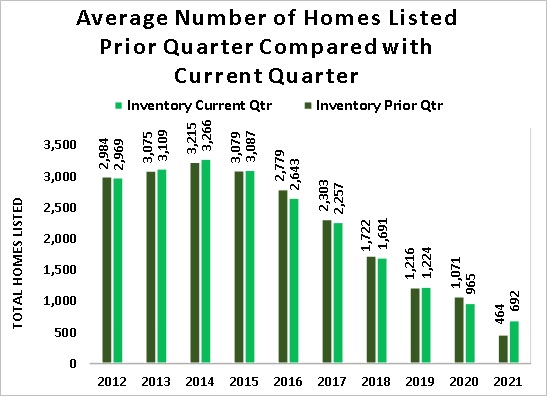

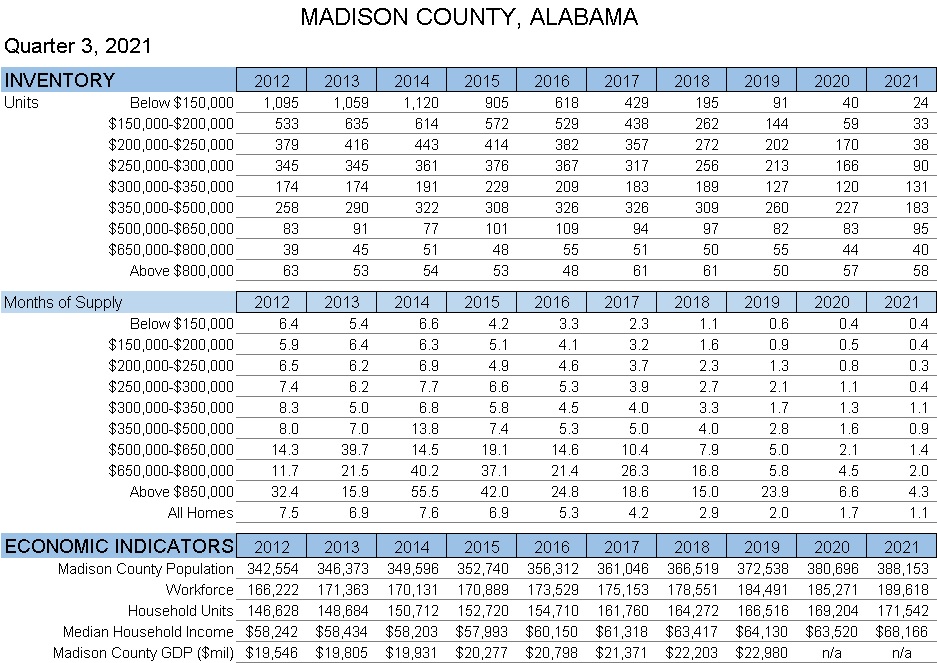

Inventory of homes rose from the second quarter to the third quarter… the first 3Q rise in seven years

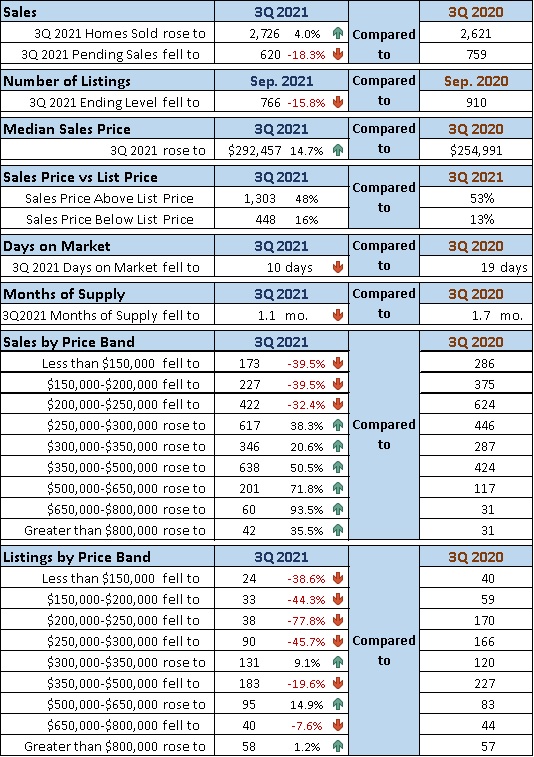

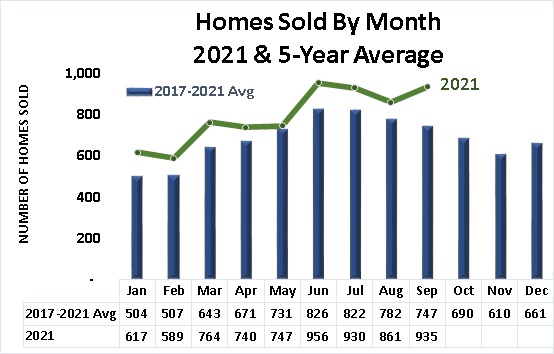

Sales level set a new quarterly sales record at 2,726

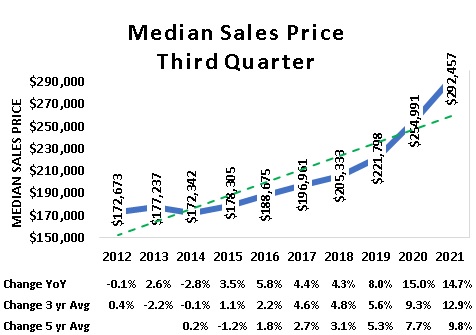

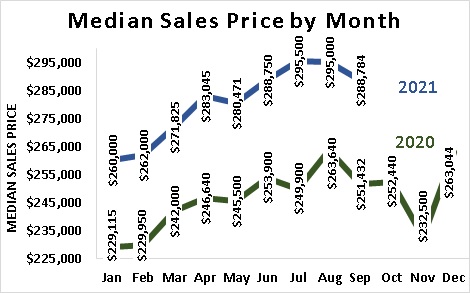

Median sales price rose14.7% from 3Q2020 to $292,457

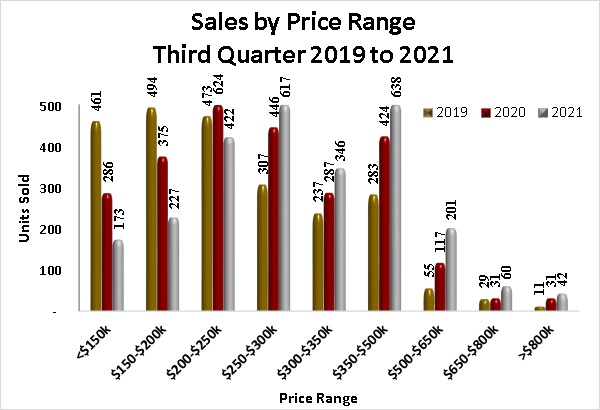

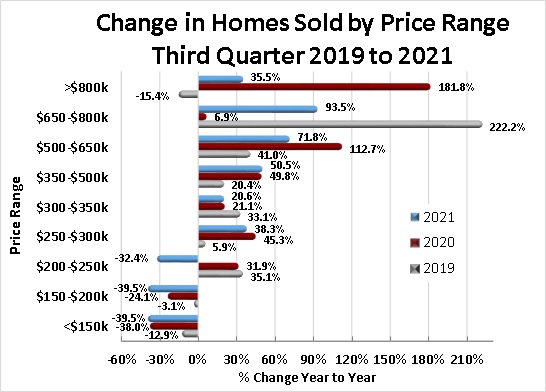

Sales of homes priced below $250,000 fell more than 30% from 3Q 2020 levels

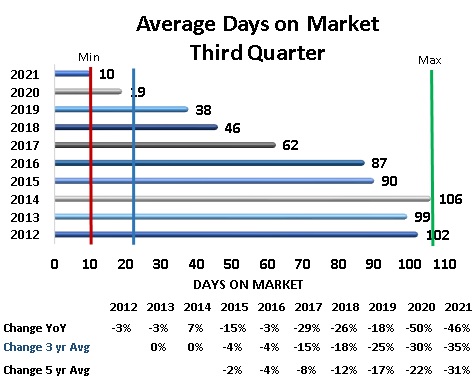

Days on market dropped to 8 days in September, lowest monthly level in at least 20 years

There were 1,476 more homes sold in 3Q than were on the market at the end of June

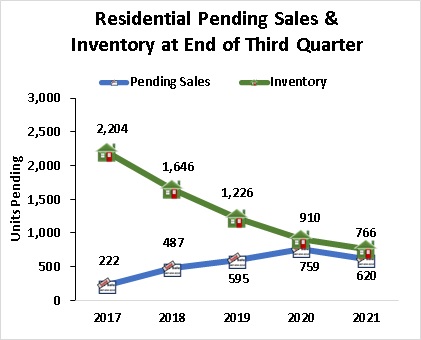

Homes available for sale increased 49% above the 2Q average. While still at record-low levels, the rise is a positive indicator of the housing market responding to the demand for housing. Sales of newly constructed homes remained high at 723 with an average of 7 days on market for 3Q. Pressure on prices remained high pushing the median sales price to $295,5000 in July and $292,457 in the third quarter. September pending sales (620) fell to the lowest level in nine months.

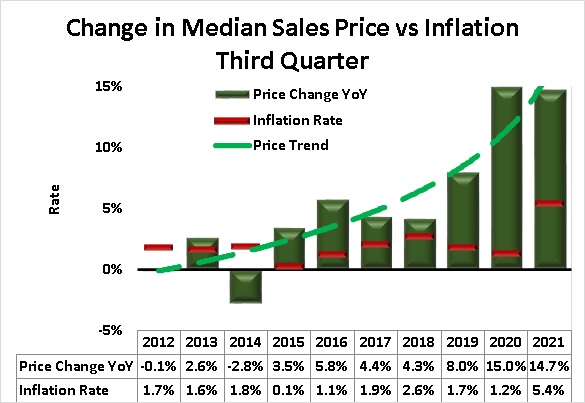

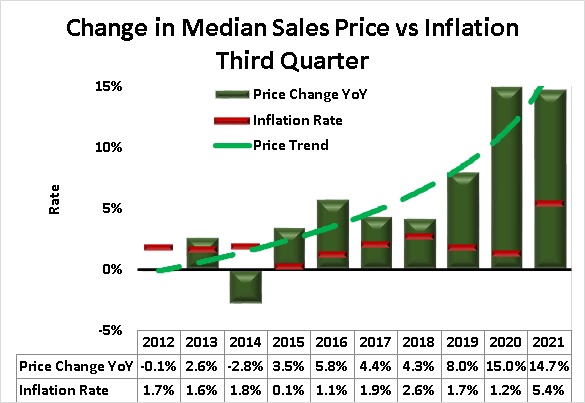

Home prices continue to rise (green dashed line in Figure 1) faster than overall inflation (red lines) even with the significant jump in inflation. Median home prices (green columns in Figure 2) in the 3Q have risen year-over-year since 2018 and the rate of increase grew to 14.6% in 2021.

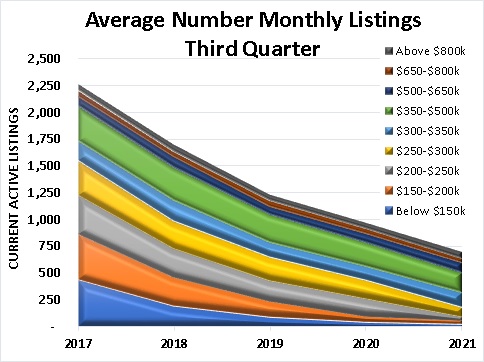

Quarter-over-quarter average number of homes available shows a significant increase (49%) in 3Q over 2Q 2021. Growth in Madison County’s population is being driven by the growth in employment opportunities which creates more demand for housing. With demand for housing growing faster than the supply, home price increased at a rate significantly above the overall inflation rate (5.4% annualized) through August 2021. See Figure 2. New home construction remains paramount in meeting the demand for residential real estate in Madison County for the forseeable future. However, major changes in factors such as mortgage rates, construction materials cost, availability of rental properties, etc., could quickly influence the momentum of the residential real estate market even in a county with a growing workforce.

3Q 2021 Market Snapshot

The Madison County residential real estate market rose again in both volume and price.

Median sales price rose to $292,457 this quarter, an increase of more than 14.7% above 3Q 2020.

Homes sold were 4% above the 3Q of 2020.

Number of homes available at the end of 3Q rose from 2Q 2021 but was below 3Q 2020 (Table 1)

3Q 2021 Key Metrics

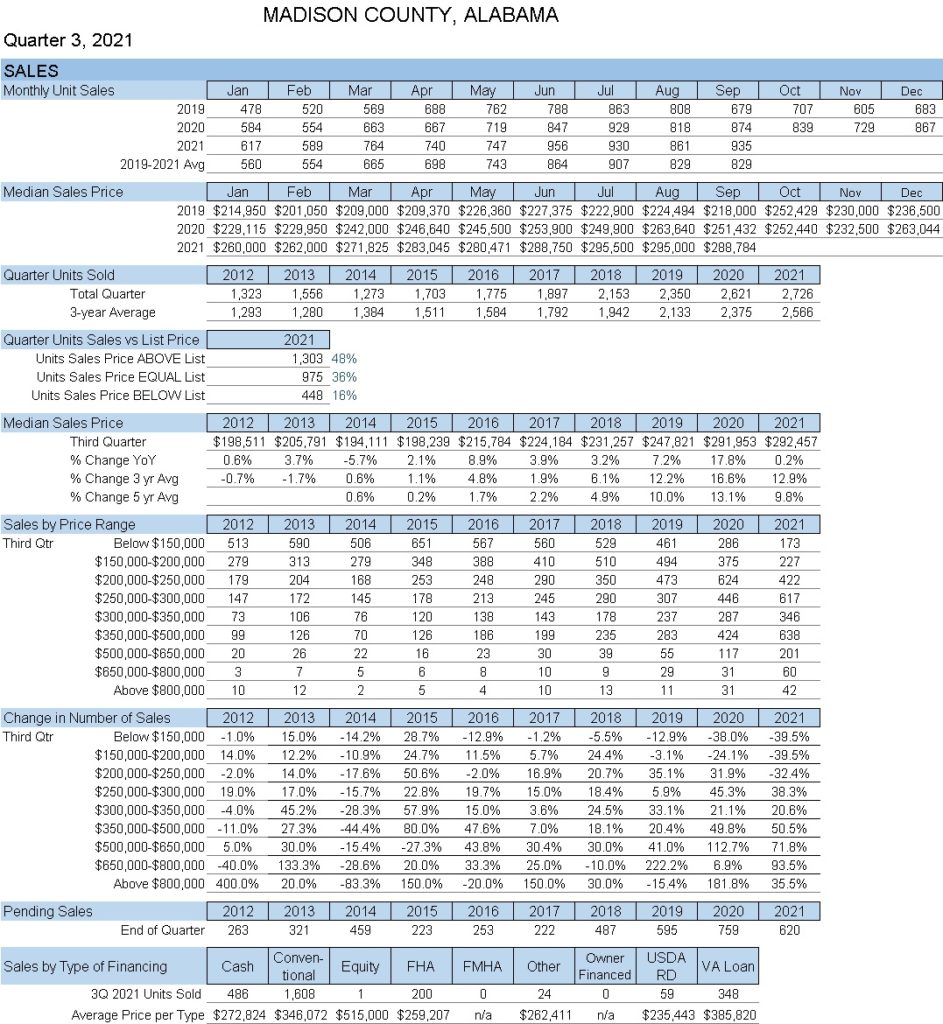

3Q 2021 sales set another third quarterly record at 2,726 and was 160 units above the 5-year average.

Median price fell slightly in September from the highs of June, July, and August 2021.

Almost half (48%) of homes sold in 3Q 2021 had a sold price above the listed price.

3Q Metrics Details

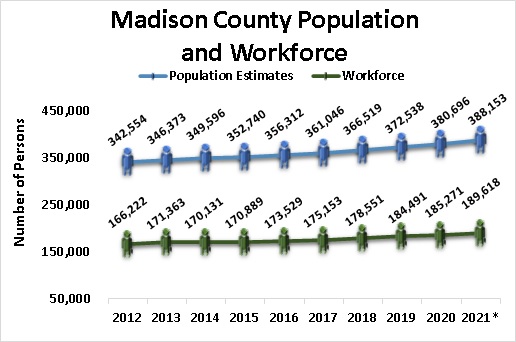

Population growth continues at a significant rate with more than 7,000 new residents added in each of the last two years. (Table 3)

September sales were higher at 935 units compared to the 5-year average of 747 homes. (Figure 3)

Inflation surged at an annualized rate of 5.4% while home prices rose 14.7% year-over-year. (Figure 4)

Total units sold in 3Q reached 2,726 which is 105 higher than the previous high of 2,621 in 2020. (Figure 5)

The median sales price ($292,457) of homes sold experienced another double-digit increase for the third quarter. (Figure 6)

The monthly median sales prices remained significantly above the 2020 monthly levels but demonstrated the normal seasonal pattern of a slight drop in August and September. (Figure 7)

Sales of homes priced above the $200-$250,000 range increased while the number of homes priced below the $200-$250 range continued to fall. (Figure 8)

The number of homes available rose in only two price bands ($300-$350,000 and $500-$650,000) in 3Q. (Figure 9)

Number of homes sold priced $200-250,000 rose in 2019 and 2020 but fell 32% in 2021. (Figure 10)

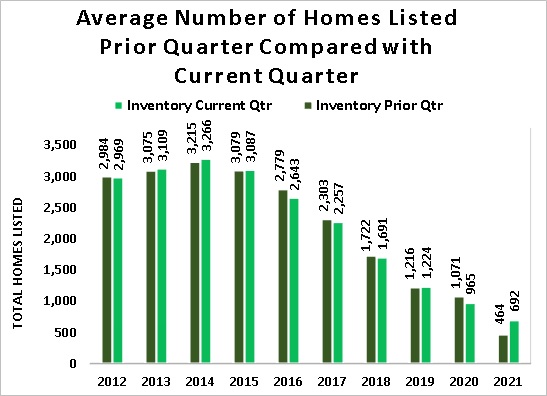

The quarterly average number of listed homes remained extremely low but rose 49% in 3Q compared to 2Q 2021. (Figure 11)

Average Days on Market in 3Q fell to another record low of 10 days in 2021. (Figure 12)

The quarterly number of homes pending sale in 3Q fell for the first time since 2017. (Figure 13)

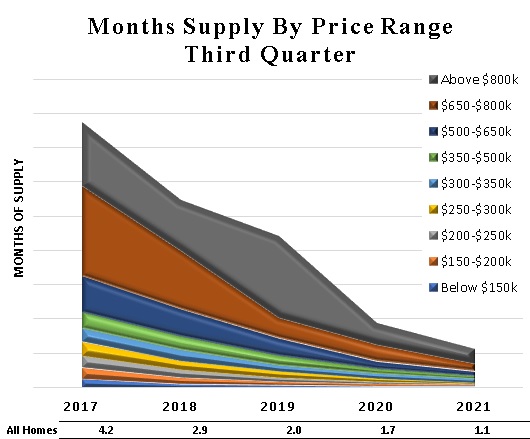

Months of supply of homes available continues to decline across all price ranges to an overall level of 1.1 months. (Figure 14)

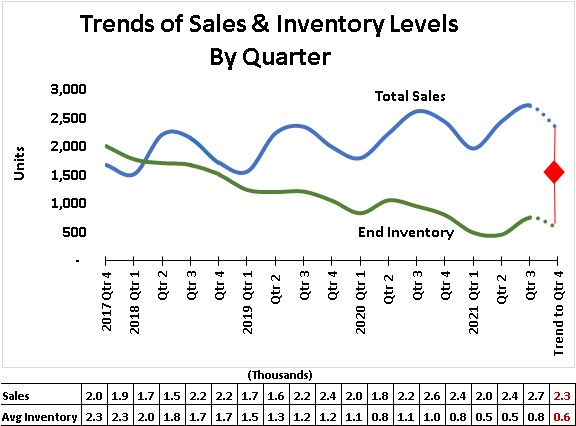

The 16-quarter trend for sales and inventory levels suggests total sales could be approximately 2,300 in 4Q 2021 while the inventory of available homes could decline to 600 units. However, if the recent rise in new construction continues, inventory could improve and support a higher level of sales. (Figure 15)

Madison County Economic Indicators

The most recent estimate of Madison County population grew to 388,153 in 2021. (Figure 16)

Madison County workforce was to 189,618 in August 2021. (Figure 16)

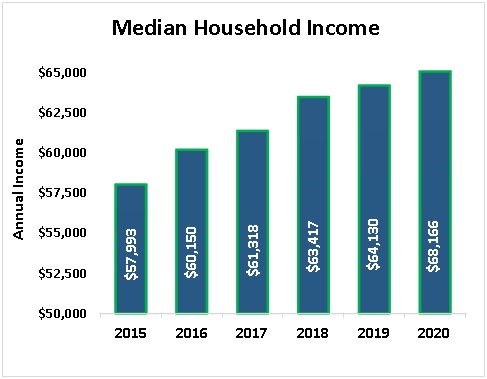

Median Household Income rose in 2020 to $68,166 (Figure 17)

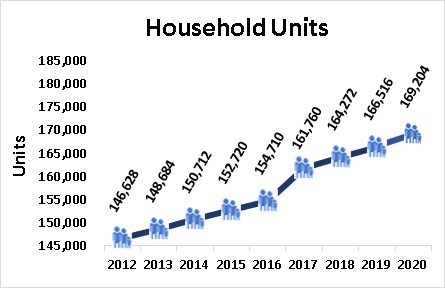

The number of household units grew to 169,204 in 2020. This represents all types of housing units comprised of nuclear families, extended families, individuals living alone as well as unrelated roommates. Housing units should generally move in relation to population trends. (Figure 18)

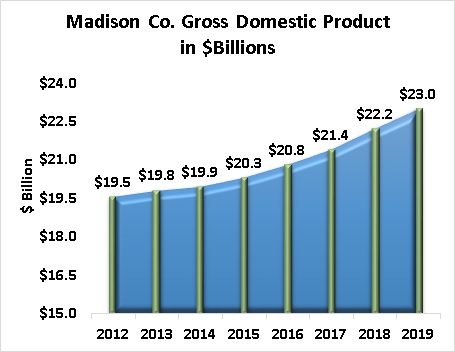

Gross Domestic Product (a monetary measure of the market value of all the final goods and services produced in a specific time period) for Madison County rose 3.6% from 2018 to $23 billion in 2019, the most recent estimate available. (Figure 19)

Data Sources:

- Alabama Department of Labor

- Huntsville/Madison County Chamber of Commerce www.hsvchamber.org/departments/economicdevelopm ent/economic-development-highlights/

- Huntsville Area Association of Realtors Monthly Housing Statistics Reports

- U.S. Bureau of Economic Analysis

- U.S. Census Bureau

- Valley MLS System

Data Sources:

- Jeff Thompson, Project Director

- Brinda Mahalingam, Ph.D., Economist

- Karen Yarbrough, Editor

Questions regarding this report may be directed to:

Jeff Thompson, jeff.thompson@uah.edu, 256.361.9061