- This event has passed.

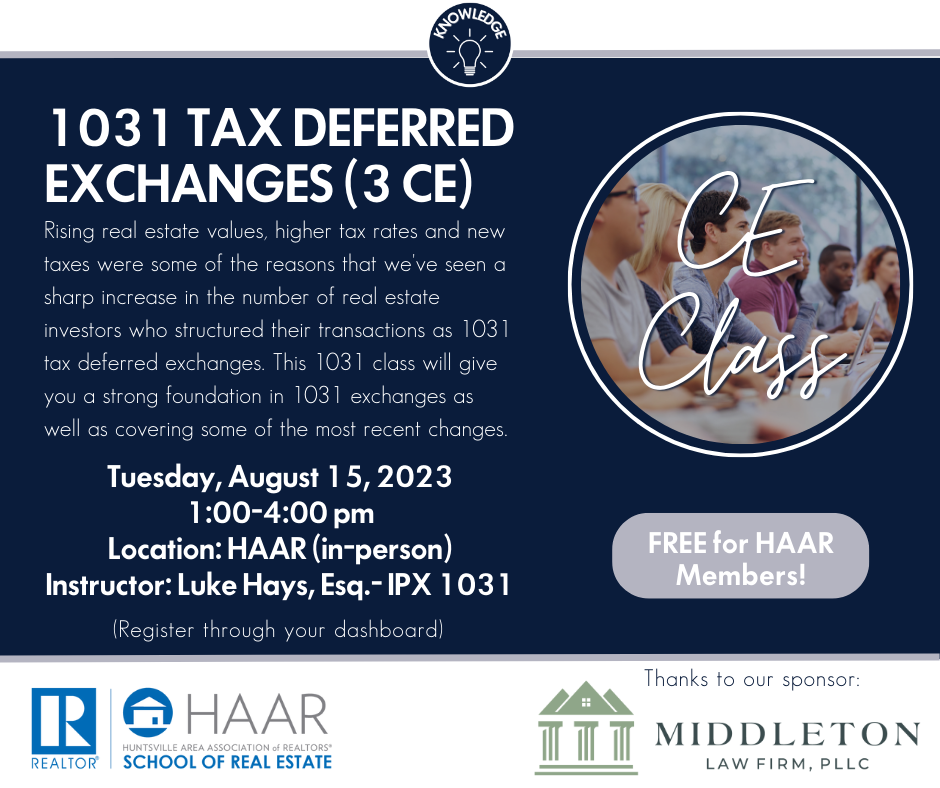

1031 Tax Deferred Exchanges CE Course

1031 Tax Deferred Exchanges Course (3CE)

Date: Tuesday, August 15, 2023, 1:00-4:00 pm

Location: HAAR- 535 Monroe St. NW (in person only)

Instructor: Luke Hays, Esq. with IPX 1031

Class Description:

Rising real estate values, higher tax rates and new taxes were some of the reasons that we’ve seen a sharp increase in the number of real estate investors who structured their transactions as 1031 tax deferred exchanges. This 1031 class will give you a strong foundation in 1031 exchanges as well as covering some of the most recent changes.

• 1031 Exchange Guidelines and the Exchange Process

• Benefits and reasons to pursue a 1031 Exchange

• Vesting Issues

• Refinancing Issues

• Like-Kind Property

• Types of Exchanges

• Today’s market and maximizing opportunity

• Partnership Issues

• Case Law regarding 1031 Exchanges

• Latest updates in 1031 exchanges and impact on investors

• In-depth look at 1031 rules, deadlines, and ID requirements

Each attendee will receive IPX1031’s latest 1031 Exchange workbook and an exchange brochure

(Useful in having when talking to clients about investment/business property)

CE Credit: 3 HR Elective

Cost: FREE for HAAR members! $35 for non-members.

Thanks to our sponsor: Middleton Law Firm, PLLC

Luke Hays Bio: Luke, a Vice President and Business Development Officer, is located in IPX1031’s Nashville office where he specializes in Real Estate Exchanges. His territory coverage includes Alabama, Tennessee, and Mississippi. Prior to joining IPX1031, Luke worked as Director of Legal

Recruitment for a Nationwide Legal Recruiting/Staffing Company. Luke frequently lecturers on 1031 Exchanges and provides continuing education seminars for attorneys, accountants, financial planners, real estate professionals and investors. He received his Bachelor’s Degree in Marketing and Sales from the University of Alabama, his JD from Tulane University Law School, and is a member of the Tennessee Bar.

CLICK HERE TO SIGN IN AND REGISTER

If you have any questions, please contact Christina Hearne at christina@valleymls.com