The following outreach is courtesy of Tiffany Medellin, CFE, who is a frequent instructor of tax preparation courses at HAAR and multiple other associations.

Until you have BOTH your 1099 AND your transaction summary from your broker, you should PAUSE your tax preparation effort.

Why?

Unless the figure on your Form 1099 EXACTLY corresponds to the net commission checks you deposited from you broker, you have a tax problem. Let me explain. Your CPA will absolutely report commission income at whatever dollar figure is reported on your 1099 since that figure was also reported to the IRS and the State.

What happens if your 1099 says $100,000 commission income, but you only deposited $95,000 in commission checks? What does that $5,000 difference mean?

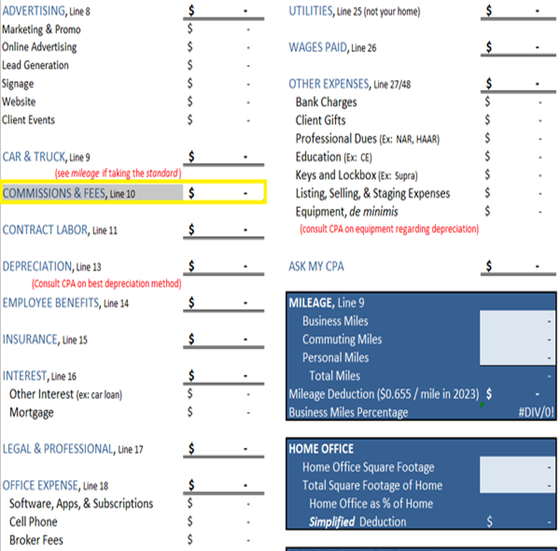

Well, that $5,000 difference was likely additional broker or transaction fees that need to be recognized as an expense on your tax return. Otherwise, you are paying tax on commission income you didn’t actually get to keep.

Because each broker does things a little bit differently, I can’t say for sure if this is happening to you.

But instead of fretting, I want you to feel EMPOWERED to take responsibility over your own tax matters.