Trends in Residential Housing in Madison County (2010-2021)

Housing demand in the Madison County, Alabama area significantly increased over the past decade. The increase has led to a reduction in the supply of available homes. With demand exceeding supply, prices are being pushed higher. The relatively strong economy, even during the pandemic response, supported steady household income levels. The economic realities of these conditions may be summarized as housing prices have risen faster than household income which has caused housing availability to drop and housing affordability to decline.

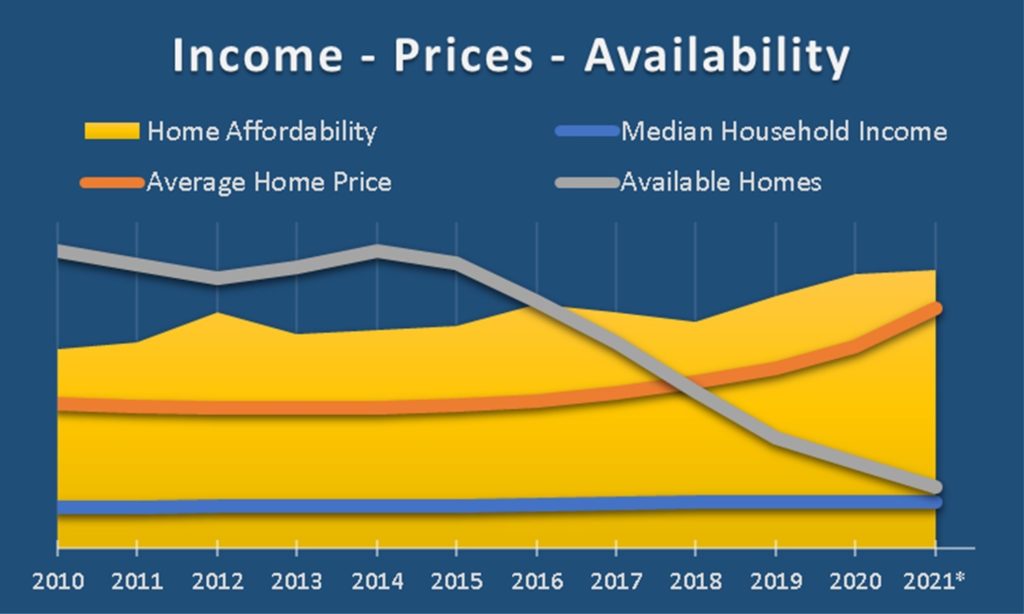

Housing Availability – Figure 1 shows the trends in Affordability, Median Household Income, Average Home Price, and available homes from 2010 through 2021 (*2021 levels are estimated). Home Affordability (gold area), Home Prices (orange line), and Median Household Income (blue line) in 2021 are all above the 2010 levels. However, the number of available homes (gray line) has significantly dropped from the highs of 2010 and 2014. Home prices have generally trended higher but began to rise at a rate faster than income since 2016.

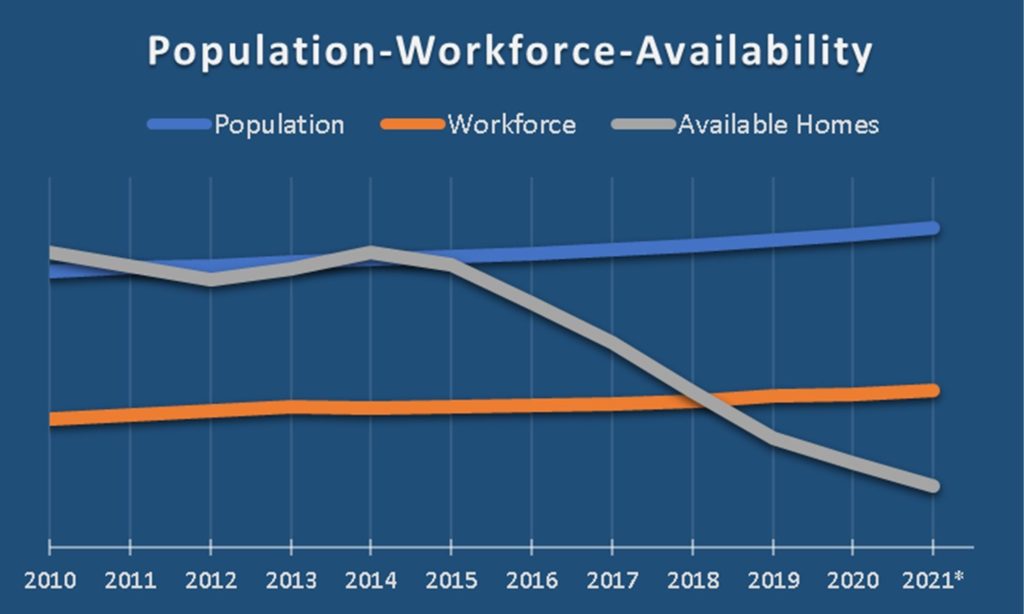

Population and workforce size continues to grow in the local area with Huntsville City becoming the largest municipality in Alabama as measured in the 2020 U.S. Census. Workers are moving to the area to take advantage of job opportunities and they need housing. Unfortunately, the availability of

homes began to decline in 2015 and is currently at the lowest levels in decades.

Population (blue line) and workforce (orange line) are trending higher from 2010. This growth has generated much of the increase in demand for housing. The supply of available housing fell beginning in 2014 as the rising demand for housing was satisfied. See Figure 2.

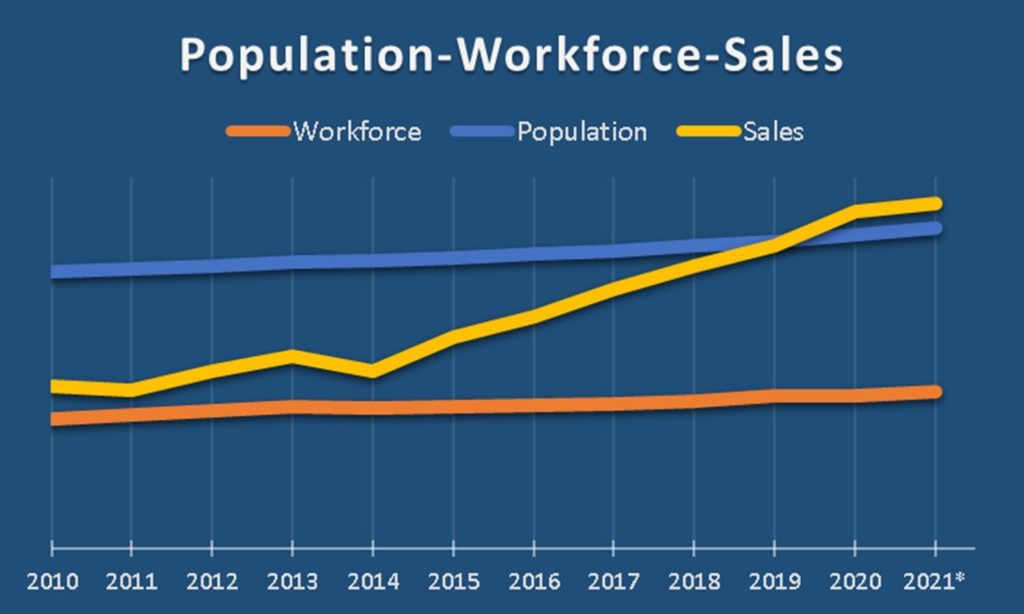

Diving deeper into the changes in demand and supply for housing shows that sales of single-family homes (yellow line) began to climb in 2014 at a faster rate than the growth in workforce or population as shown in Figure 3. The slight reduction in the rate of home sales anticipated for 2021 stems from the drop in homes listed for sale.

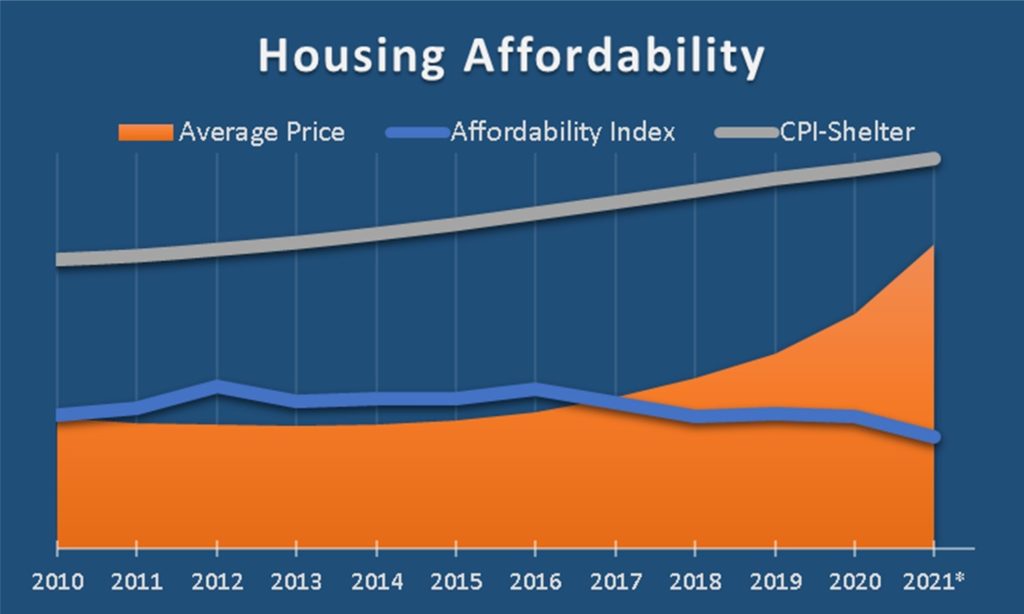

Housing Affordability – can be defined in numerous and ever-complex ways but at its core, housing affordability represents the ability of the “typical” household to qualify and pay for a home in a local area. Determinants of affordability include price, mortgage rates, household debt load, down payment requirements, etc. Changes in any one of these variables can significantly affect affordability of housing especially for a specific household. Each household is unique in resources and each available home offers varying features/benefits. Matching needs with availability is challenging in the best of times but may be nearly impossible in times of a diminished supply and/or and falling affordability.

Housing Affordability in Madison County, Alabama last peaked in 2016 and has trended lower

since. The average home selling price began to rise more rapidly, not coincidentally, in 2016. Comparatively, the housing component of the Consumer Price Index is the costs for shelter. The gray line in Figure 4, shows housing costs have trended higher in the nation steadily since 2010 while the local average sales price has risen much faster than the national rate since 2016. U.S. News and World report ranked Alabama 25th for 2019 housing affordability.

The Affordability Index for Madison County, Alabama (blue line) declined from 2016 through today

shows that not only are prices increasing but also housing that meets the needs of new households in Madison County is more expensive if available at all.

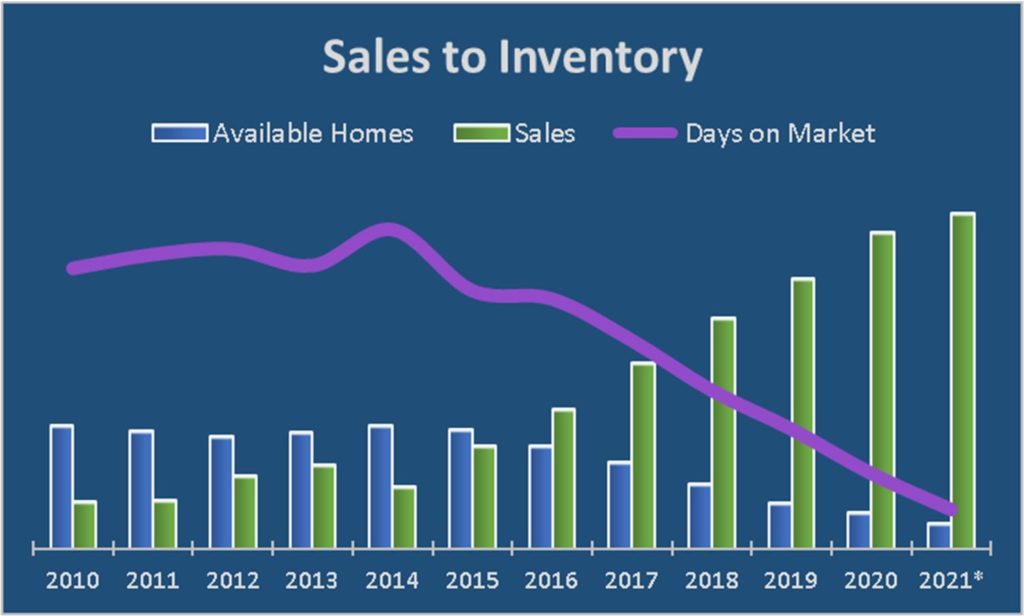

Availability of homes varies with changes in sales, new listings of homes for sale, as well as new construction. The number of homes sold in 2016 in Madison County exceeded the number of homes listed for sale at the beginning of 2016. By 2018, annual demand for homes was more than twice the supply of homes listed for sale at the beginning of 2018. This rapid increase in home sales can be seen in the Days-on-Market metric shown by the purple line in Figure 5. Days-on-Market has dropped dramatically since 2016 to the current 13 days-on-market in August 2021.

Housing Attainability – is a metric for an area that basically refers to the ability of a “typical household” to buy a home they can afford and that meets their needs. Attainable houses are those that can be purchased by households (or at least qualified to buy) with income between 80% and 120% of the median income in the area. The Housing Attainability metric has generally declined in Madison County, Alabama since 2014. Figure 6 shows the maximum price of a home (yellow line) that is be affordable for households with income of 120% of the median income compared with the average number of homes available for purchase (blue columns). The green line represents the homes that households with 80% of median income could qualify to purchase. Housing Attainability has generally declined in Madison County mostly due to the drop in the number of available homes for sale priced at or below levels that households with incomes between 120% and 80% of the median household income can afford.

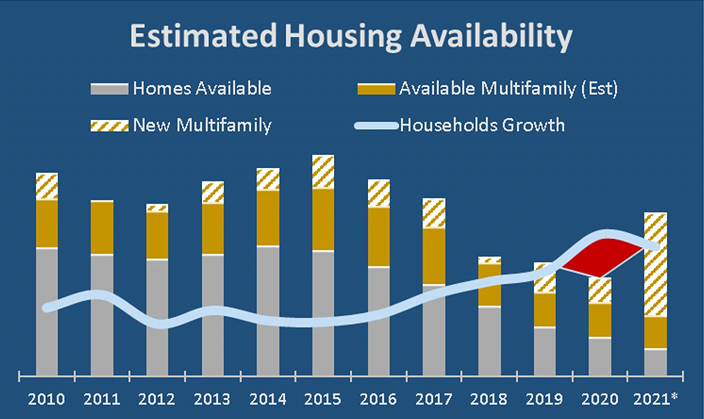

Multifamily housing – is an important component of the local area’s housing availability even though single family homes comprise most of the housing in Madison County, Alabama. From 2010 to 2019, the number of multifamily units in the area rose more than 50%. In 2020, plans and permits for construction of multifamily homes increased significantly. By the end of 2021, the number of multifamily home units could be greater than 30,000… a level more than double the number in 2010. Even more units are planned to come online in 2022 and beyond. [Multifamily housing data provided by and used with permission of David Wilson of Berkadia, berkadia.com]

Figure 7 shows the number of homes available (listed for sale), existing multifamily homes available (estimated through 2021), new multifamily homes coming online, and the growth in households (blue line). In every year except 2020, the total number of homes available exceeded the growth in the number of households. In 2020, there was a gap (red area in Figure 7) in meeting housing needs based on the number of new households relocating here to exceeding the number of homes (single family + multifamily) available in Madison County. With the new housing construction underway, this gap in meeting housing demands could be filled by the end of 2021. It should be noted that this analysis does not adequately represent reality because available homes may not meet the needs of a household for any number of reasons such as location, size, cost, features, etc. Fortunately, new home construction improves the ability for the supply of residential real estate properties to meet the demands of the growing number of households in Madison County.

In conclusion – housing affordability is declining but may stabilize with more newly constructed single family and multifamily homes coming online in 2021 and beyond. Financial variables such as mortgage rates and lending requirements may change which could impact the ability for new households to qualify to purchase or rent a home. Location, size, features, price, etc. will ultimately determine how well the local area meets the demand for housing during the planned economic expansion over the next few years. Finding a home in Madison County that meets the needs of new households may continue to be challenging for months or a few years. An increase in the rate of new properties becoming available will be an important factor in how well the local area welcomes new households to our community. Additional residential development for both single family and multifamily housing is critical to the future prosperity of Madison County and North Alabama.

Acknowledgements

30 Year Fixed Mortgage Rate – Historical Chart, August Macrotrends LLC

Alabama Labor Market Information , Alabama Department of Labor

Buck August 2021. Southern Exposure Information, Inc. reportconstruction.com

David Wilson, May Multifamily Market Overview, Huntsville, Alabama. Berkadia, Berkadia Proprietary Holdings, LLC

Federal Department of Housing and Urban Development

Federal Reserve Economic Data, Louis Federal Reserve Bank of St. Louis

Defining Housing Affordability. 14 August PD&R EDGE, U.S. Department of Housing and Urban Development, huduser.gov

National Association of Realtors – Research & Statistics

Rosen, Bank, al. June 2021. Housing is Critical Infrastructure: Social and Economic Benefits of Building More Housing. Rosen Consulting Group (RCG).

S. Bureau of Economic Analysis

S. Census Bureau

Valley Multiple Listing Service, North Alabama

Analysis performed by:

The University of Alabama in Huntsville Center for Management & Economic Research

Jeff Thompson, Project Director

Karen Yarbrough, Editor