A Decade of Growth

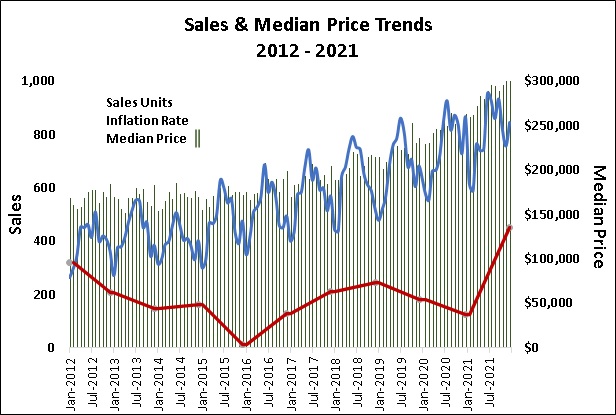

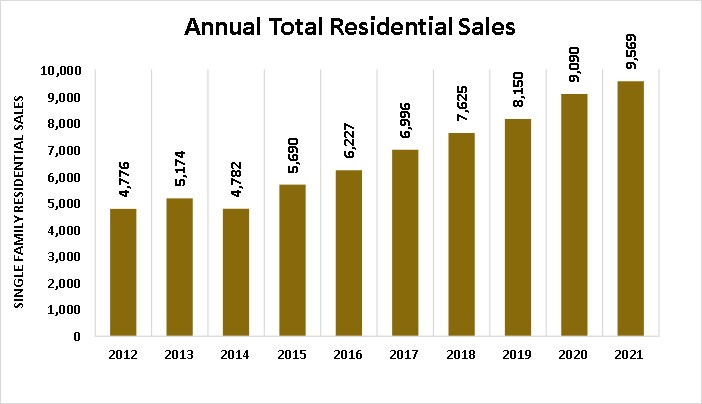

The strength of the local economy is reflected in the residential real estate market of Madison County, Alabama. Since 2012 the number of homes sold, and the home median sales price have trended higher in an annual seasonal pattern. The number of homes sold annually has doubled from 4,776 in 2012 to 9,569 in 2021.

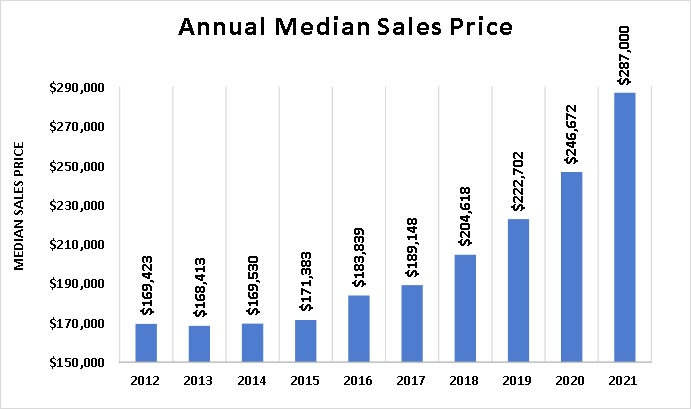

The median sales price grew approximately 70% during the same period to an annual level of $287,000.

By comparison, the U.S. inflation has fluctuated from 1.7% in 2012 to a low of 0.7% in 2015 to about 7% in 2021 which suggests that the rise in home prices resulted from increasing demand.

Figure 1 shows the seasonal sales pattern (blue line) of highs during the summer and lows during the winter months. The monthly median sales price (columns) fluctuated month-to-month prior to 2020 but grew more consistently during 2021 and significantly above the inflation rate (red line). The decline in the homes-for-sale inventory coupled with a population growth of over 50,000 since 2012 have been significant contributors to the higher home prices. Strength in home sales and price levels should continue in the near term as Madison County welcomes new employers and residents.

2021 Annual Recap

Prices (median) for residential real estate in Madison County reached new monthly highs nine times during 2021. Rising prices had minimal impact on housing demand based on the homes sold and the average days-on-market falling to single digits. Annual home sales of 9,569 was an all-time high with a record monthly sales level (956) occurring in June.

The grand total of all sales grew to $3.1 billion in 2021, 21% above the $2.5 billion of 2020. Existing home sales totaled $2.1 billion and new construction sales reached $961 million with condos & townhomes jumping 57% to $38 million during 2021. See Figure 2.

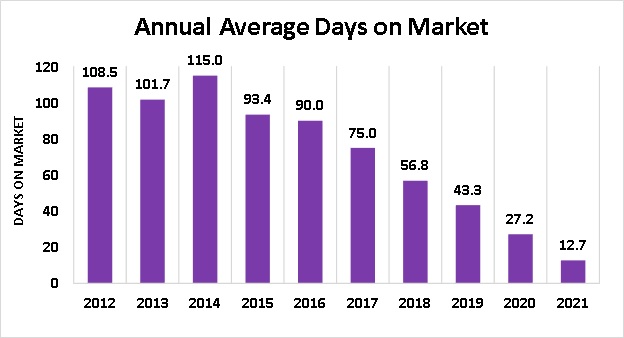

The 9,569 properties sold had an average days-on-market (DOM) of 13 days compared to 27 days last year and 90 days in 2016. The median sales price rose 16.3% to $287,000, higher than the 2020 level. There were approximately 9,730 new listings during the year. By the end of 2021, there was only 0.7 months (21 days) of supply. For perspective, convention suggests that a balanced market has a 6-month supply of homes.

Sales Volume

Sales volumes increased in three quarters of 2021 relative to 2020.

Inventory of Homes Listed

The number of homes available continued to fall in 2020 hitting a low of 460 in May and climbing to 601 by year-end which was down 21.3% from Dec. 2020. The positive trend in newly constructed homes continued from 2020 to a monthly average of 230.

Days-on-Market

Average days-on-market for 2021 was 13 days, less than half of the 27 days-on-market in 2020.

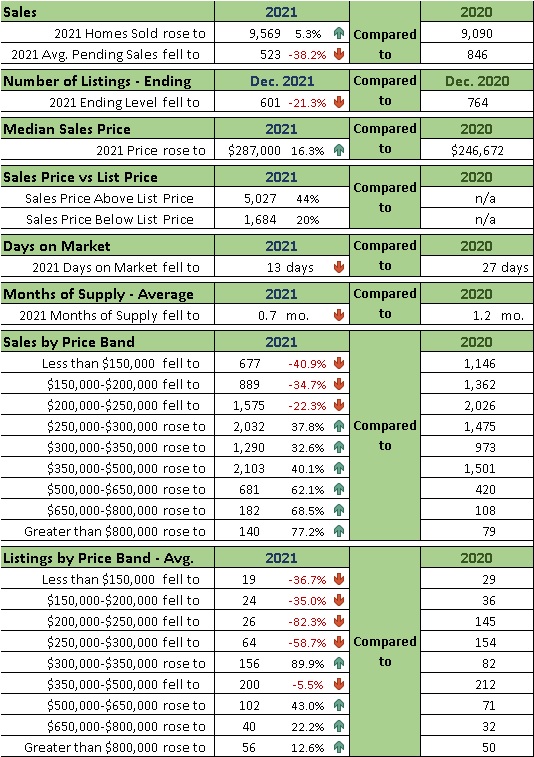

Prices

The median sales price of all homes sold grew 16% to $287,000, a record annual median sales price level. By Price Band, sales for homes priced below $250,000 fell 31%. Homes priced below $150,000 fell 41% from 2020 levels. Sales of homes priced above $800,000 rose 77%. The greatest number of homes sold were priced between $350,000 and $500,000.

Listings of homes available for sale dropped dramatically in the lower price-bands. The largest average number of homes listed for the year was for homes priced between $300,000 – $350,000. Inventory of homes for sale improved for homes priced above $500,000. See Table 1.

Units Sold: The total number of residential units sold in 2021 (9,569) increased 5.3% from 2020 and 100% from 2012. The annual number of units sold has risen each year since 2012 except for the small decline in 2014. See Figure 2.

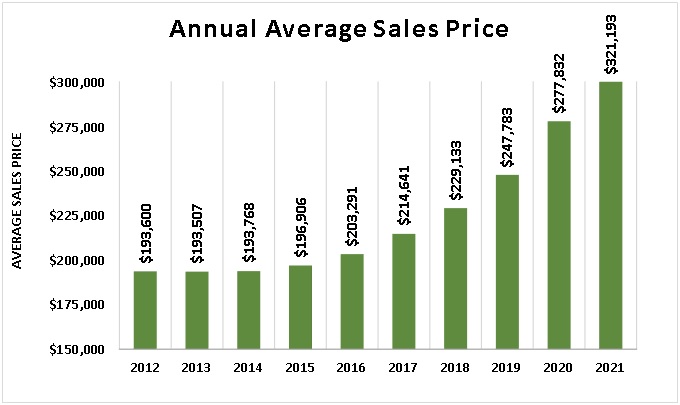

Sales Price Levels: Sale price levels rose more in 2021 than in any year since 2012. The annual average sales price reached $321,193 in 2021, up 15.6% from 2020, a record one-year increase. Since 2012, the average sales price has increased 66% from the 10-year low of $193,507. See Figure 3.

The median sales price represents the price point at which about 4,785 homes sold at a lower price and 4,785 homes sold at a higher price in 2021. Annual median levels rose throughout the decade, up 70% since the low in 2013. The 2021median price rose 16% to $287,000 from the 2020 level. See Figure 4.

Average Days On Market: Number of days-on-market (DOM) is a measure of the length of time a home is listed for sale. In 2021, the average days-on-market fell to an average of 12.7 days for the year. A falling DOM may suggest a rising demand or a falling supply, or both which occurred in 2021. See Figure 5.

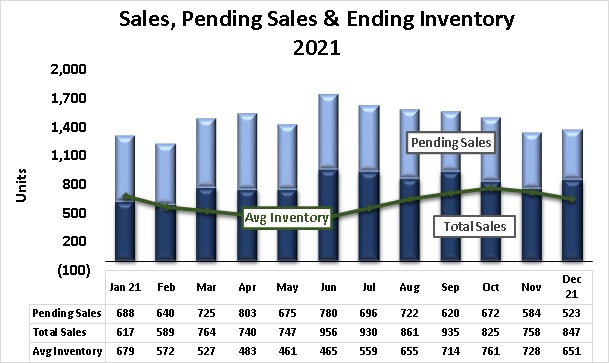

Sales & Inventory: Home sales for the year totaled 9,569 with the peak in June. The total number of monthly sales exceeded the average number of listed homes every month except January in 2021. The monthly average inventory was greatest in October at 761 homes. See Figure 6.

Total pending sales peaked in April at 803 but was stable for the year.